Total reward statements

The EU Pay Transparency Directive: Why global organisations are using Total Reward Statements as the core pillar of their strategy

18.11.24

With a growing global focus on improving DEI and progressing towards equal pay, the EU Pay Transparency Directive is a hot topic. It aims to align EU Member States with common standards for equal pay and strengthen existing regulations. While it’s a significant step towards closing the gender pay gap, the directive also has important implications for reward and benefits strategies, which we have discussed in a previous blog here.

In a recent webinar I was joined by Elouise Rolo, Director of Global Benefits at Sequoia. We explored the implications of this significant piece of legislation and how organisations can proactively respond. We also covered the readiness of organisations to meet its requirements, and the part technology, especially Total Reward Statements (TRS), will play in helping organisations streamline compliance efforts, while empowering a more transparent and equitable workplace.

How ready are HR and Reward leaders for the EU Pay Transparency Directive?

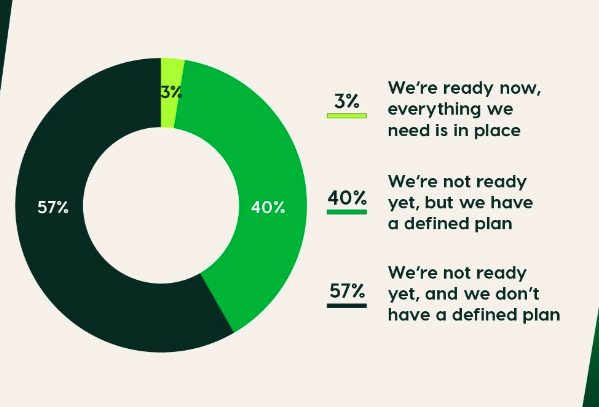

We surveyed our audience of HR and reward leaders to gauge their readiness for the directive, and the results revealed a significant divide in preparedness. Many organisations are still grappling with the changes this directive will bring.

The majority of organisations indicated that they are not ready to meet the directive’s requirements, with 57% lacking a defined plan. In contrast, 3% reported being fully prepared with everything in place.

When it comes to team responsibility, 84% of respondents identified the Reward team as the primary driver for delivering on the directive’s requirements. Other teams mentioned include People, Insights, and Compliance. As the remit of reward and benefits leaders continues to expand, it seems that driving compliance and equity initiatives will be added to their already growing list of responsibilities.

Organisations are also expecting to rely heavily on their HRIS vendors to meet reporting requirements – 82% highlighted the need for support from this vendor. While a smaller percentage mentioned the role of payroll and analytics providers.

Interestingly, only 37% of respondents currently offer TRS to some employees, while half are considering or reviewing its feasibility – highlighting a readiness gap in communicating the full scope of employee rewards, a key directive requirement.

Although the legislation won’t be enforced until 2026, organisations need to start preparing now to ensure they have the right plan in place when the directive takes effect. Based on our survey results, it seems many organisations still have significant ground to cover.

The global pay transparency landscape

Pay transparency laws are not new – countries like the U.S. and Australia have already introduced legislation to address pay disparities, not just by gender, but also across other protected characteristics like race and disability. And each country takes a unique approach to meet its specific goals. These laws aim to promote fair pay, empower employees in salary negotiations, and ultimately achieve equal pay for equal work.

“Without transparency, pay discrimination often remains hidden, making it difficult for workers to identify inequalities.”

– Elouise Rolo, Director of Global Benefits, Sequoia

However, The EU Pay Transparency Directive goes a step further by focusing on both pay transparency and pay equity. It introduces a broader definition of total rewards to include not just salaries and bonuses, but also benefits like health insurance, company cars, and pensions. Because of this, TRS provides a practical solution for organisations, as they offer a comprehensive view of all elements of reward. This holistic approach ensures all aspects of employee rewards are considered in addressing pay equity.

Employers need to review their benefits offerings to ensure their practices can be justified on objective, non-gendered grounds. For instance, if an organisation funds annual health assessments for senior roles while others self-fund.

Challenges with country-specific reporting

Organisations face uncertainty in how different EU countries will implement the directive, particularly around reporting. Each Member State may have its own thresholds and guidelines, creating potential discrepancies, and adding complexity for companies operating in multiple countries, as reporting requirements could vary significantly.

TRS helps address this challenge by offering a consistent framework for consolidating and reporting total rewards across multiple jurisdictions. Whether reporting is required at the country level or through consolidated company-wide reports, organisations are using TRS to maintain clear, accurate data for compliance.

How organisations are preparing for the change in legislation

The first step is to gather pay and benefits data from various sources, including HR systems, payroll, insurers, brokers, and advisors. Talking to this point, Elouise highlighted the difficulty some companies Sequoia work with have faced trying to compile this data manually.

“The data may be coming from multiple sources. If you just think about benefits, it could be coming from HRS systems, payroll, insurers, brokers, advisors. And I’ve seen clients trying to pull this together manually in some cases. And it’s a challenge. It’s quite a heavy lift.”

– Elouise Rolo, Director of Global Benefits, Sequoia

Benefits technology, including TRS, streamline this process by centralising all reward data, reducing the risk of error, and easing the administrative burden. Collaborating with IT and data management teams early on in this process will help avoid overwhelming current systems.

Employers will also need to review their pay structures and benefits offerings, with a goal of being able to justify discrepancies using objective, gender-neutral criteria. TRS provides a clear, customisable snapshot of each employee’s total compensation package, helping to identify and address any disparities. If significant pay gaps are discovered, companies should analyse the underlying causes, considering market rates and employee demographics, and develop a suitable plan to address them.

Clarity on each EU country’s specific reporting guidelines will emerge leading up to the June 2026 deadline, and companies should be ready to implement reporting processes and establish an ongoing framework to maintain compliance.

The role of TRS in valuing pay and benefits

An area of uncertainty among reward and benefits leaders lies in how components like pensions and supplementary benefits will be valued. TRS simplifies this by offering a consolidated view of both mandatory and employer-specific benefits, making it easier for employees to understand the full value of their compensation. By implementing this, organisations ensure consistency in reporting and compliance with local guidelines.

How technology will help support organisations through this process

To manage the extensive preparations required, organisations will need to consider utilising technology to support their efforts. Many processes involved in data collection and analysis can be labour-intensive and manual. Implementing technology can help automate these tasks, reduce the manual workload, and improve overall efficiency. This includes integrating systems to pull data from various sources and supporting compliance reporting to adapt to the evolving legal landscape.

TRS clearly communicate pay structures and benefits to employees and mitigate concerns employees may have about transparency. Implementing a digital platform that consolidates all reward data can streamline this with TRS that include both salaries and benefits. It will also save HR teams time by automating statement generation and reducing errors caused by manual processes.

Looking forward…

Overall, the EU Pay Transparency Directive is pushing for a deeper level of transparency across total reward structures. TRS is the tool to offer transparency by communicating the full value of employee compensation.

As we await more specific guidelines, organisations should begin assessing their current practices and ensuring they are equipped to meet the demands of the directive. The focus on transparency aims to create consistency across the EU, but the journey to achieving that goal may be more complex than anticipated.

Want to delve deeper into the insights shared by Adam Mason, EVP at Benefex and Elouise Rolo, Director of Global Benefits, Sequoia? Watch the full on demand recording of the webinar, ‘The EU Pay Transparency Directive: Are you ready for a new conversation about total reward?’, here.

Associated products and services

Adam Mason

EVP Global