Blog, Employee Benefits

How can you drive maximum value from your employee benefits?

21-02-2024

In the next 12 months, employers are planning to increase their investments in wellbeing (76%), benefits (71%), recognition (64%) and HR insights and analytics (61%). Despite this upward trend in enhancing the employee experience, employee expectations are outpacing the scope of reward budgets.

So, ‘doing more with less’ is a theme that continues to crop up as HR and reward leaders look to drive more from their existing programmes and budgets — and save time and resource with the help of technology.

Here are three ways you can optimise your budget and do more with less:

1. Use technology to cut the administration burden

The need to modernise outdated administration processes is a common driver for implementing global benefits technology. For global organisations that are growing their benefits offering, the administration becomes increasingly complex as they add new providers.

The right tech helps reward and benefits teams to streamline processes, save administration hours, and reduce the need for manual intervention. This ultimately enables teams to focus on other strategic reward initiatives and big-picture thinking.

Here’s how three global enterprises cut huge chunks of admin out of their benefits processes:

2. Optimise existing benefits spend

If you want to know if you’re allocating benefits spend where it’s most valued, here are some ways you can optimise it:

- Identify which benefits are under-valued by employees and redirect spend towards benefits that will have a greater impact.

- Negotiate lower premiums where possible – consider re-investing any savings in benefits and other wellbeing initiatives.

- Make the most of value-added services from insurers – such as Virtual GPs and wellbeing apps. As well as delivering real value for money, this will result in more positive employee outcomes.

3. Increase choice, not cost

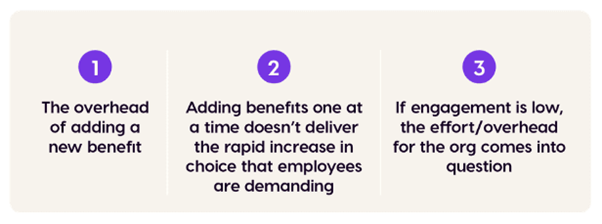

Employees say they want benefits that are more personalised and relevant (57%) and give them more choice (50%). Employers are increasingly looking to serve this demand for more choice by expanding the benefits portfolio.

This creates three challenges:

Adding new benefits to your scheme is resource-intensive and adds cost to the overall programme. Many of the new benefits on offer (take the latest in menopause support as an example) are designed to serve particular groups, so by their nature are going to have limited mass appeal. As a result, we’re seeing more organisations look outside the traditional benefits scheme to help them bring the wellbeing, retention and engagement outcomes they’re seeking; we’re talking about Benefit Allowances.

Unlocking choice with benefit allowances

Allowances get around the admin and take-up challenges in benefits. And because they can be offered universally, allowances can provide maximum choice and flexibility. Employees can choose (within your rules) to make absolutely anything a benefit: Netflix, Spotify, hellofresh, food on Deliveroo; anything you allow.

Alongside that infinite flexibility, they support reward leaders looking for ways to do more with little or zero cost and admin. Employees typically spend around 80% of their full allowance, so assuming a benefits budget was transferred to allowances, organisations would see a 20% saving in benefits spend — even before the administration cost savings of multiple provider reports are considered.

’How can we do more with less?’ was one of the questions we answered in our recent report: The 5 things we bet your CPO will ask you in 2024. Get your copy to uncover the other themes we reckon will be dominating your interactions with the CPO, such as AI, achieving your wellbeing goals, and driving benefits success.

Adam Mason

EVP Global & Enterprise, Benefex