Blog, Cost-of-living crisis

Rising costs in the UK and the impact on retirement planning

09-02-2024

The rising cost-of-living has caused the Pension & Lifetime Savings Association (PLSA) to revise its estimations of what level of savings will be required to fund a ‘minimum’, ‘moderate’ or ‘comfortable’ level of retirement. Rising costs, combined with a realisation that grandparents in retirement may want to offer financial support to grandchildren, has pushed up the income required to achieve a moderate level of income in retirement by over 34% (£8,000 more per annum).

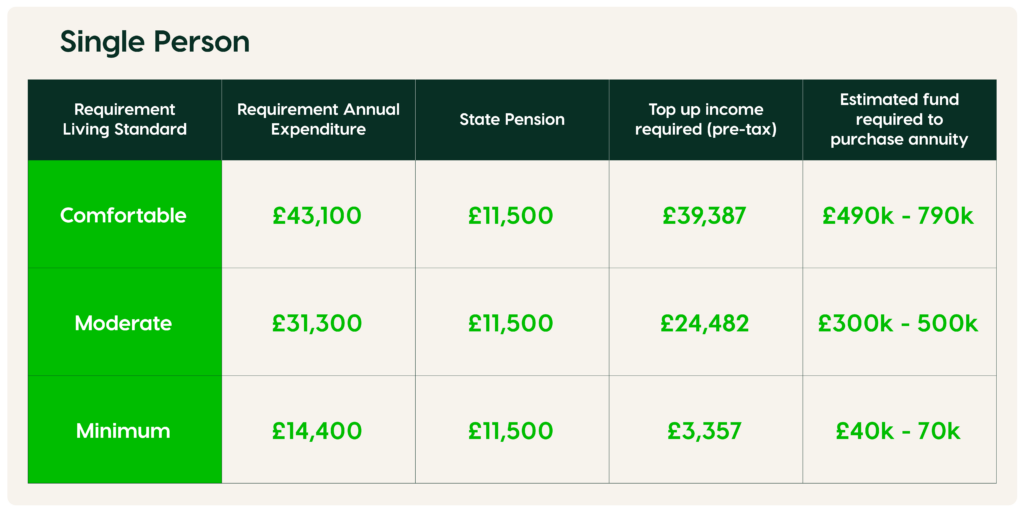

They now estimate that a single person needs £14,400 a year for a minimum income, £31,300 for a moderate lifestyle, and £43,100 a year for a comfortable retirement.

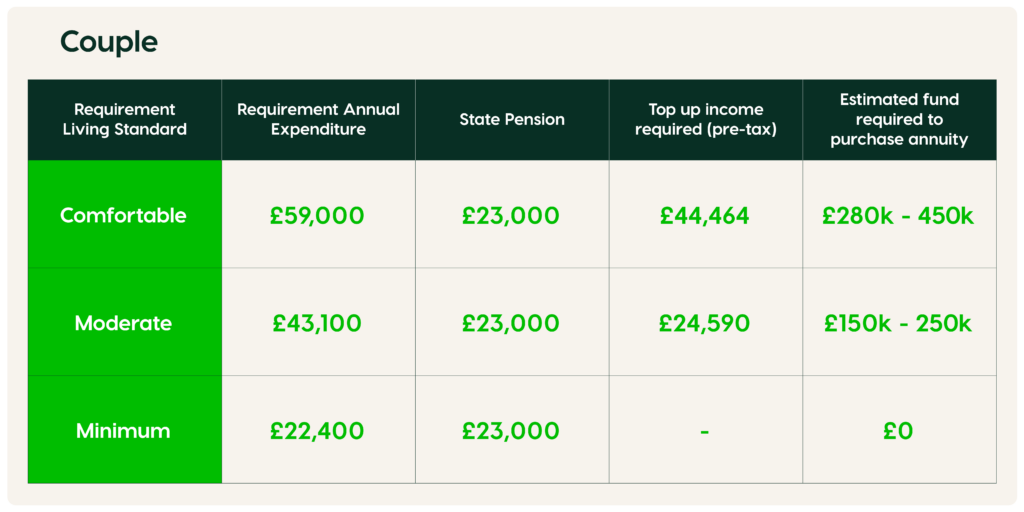

Couples require an annual income of £22,400 at the minimum level, £43,100 at a moderate level, and £59,000 at a comfortable level.

The current State Pension for a couple (assuming they are in receipt of the full amount) equates to £23,000 and meets the minimum level required; however most people will be aspiring for more than a minimum standard of retirement that covers needs, with a small amount left over for fun. Despite the recent increases, the State Pension is further away from providing a moderate standard of living now than it was a year ago.

Below we have detailed what an estimated fund may be to reach the required level of income.

Single Person

Couple

It is important to note that these figures assume that the retirees are living in their own home and have already paid off their mortgage, so have no mortgage or rental costs. Recent research has shown however, that more than 30% or retirees are likely to be paying a mortgage or renting in retirement, so the required income may be many thousands of pounds more, depending on where they live.

This highlights the need to support employees in understanding the importance of retirement saving, and ensuring they are saving more over the longer term, to give them the best chance of living the life they want in retirement.

We would like to see urgent action from the government to push forward with the next stage of Automatic Enrolment and increase the minimum levels of contributions, but even then it is likely that most people will need to contribute above these levels to have the retirement that they expect.

Here are three ways employers can help engage employees with their pensions and save more towards retirement:

1. Educate employees – running webinars or drop-in sessions for employees is a great way to get them thinking about their pension. For example, a webinar that takes them through the Retirement Living Standards levels is a practical way to get them thinking about how much they’ll need for the retirement they envision.

2. Make it easy for employees to increase their pension contributions using a benefits platform like OneHub. Employees can see how much tax they can save by increasing contributions, and the impact on their take-home pay.

3. Remind employees to keep their details up to date with their various pension providers – there are an estimated 1.6 billion lost pension pots in the UK, worth around £37 billion.

More information about the Retirement Living Standards and the PLSA’s calculations, along with the assumptions as to how retirees will be spending in retirement, can be found here.

The workplace savings team here at Benefex can help you engage and educate your employees on pension provision, for more information please contact your usual Account Manager or [email protected].

Andrew Barradell

Head of Workplace Savings, Benefex