Blog, Cost-of-living crisis

Supporting employees through the cost-of-living crisis: Active financial planning for the future

10-07-2023

The cost-of-living crisis is continuing to put significant pressure on employees’ finances – with the ONS reporting that two-thirds of adults in the UK are spending less on non-essentials, 23% are using more credit or borrowing more, and one in three are finding mortgage or rent payments difficult. Financial wellbeing can of course have a knock-on effect on employee mental and physical wellbeing.

And, at a time when people are stretched, they might not be thinking about taking financial advice. But as an employer, you’re uniquely placed to help them to start actively planning for their financial future and to support them in building their financial confidence.

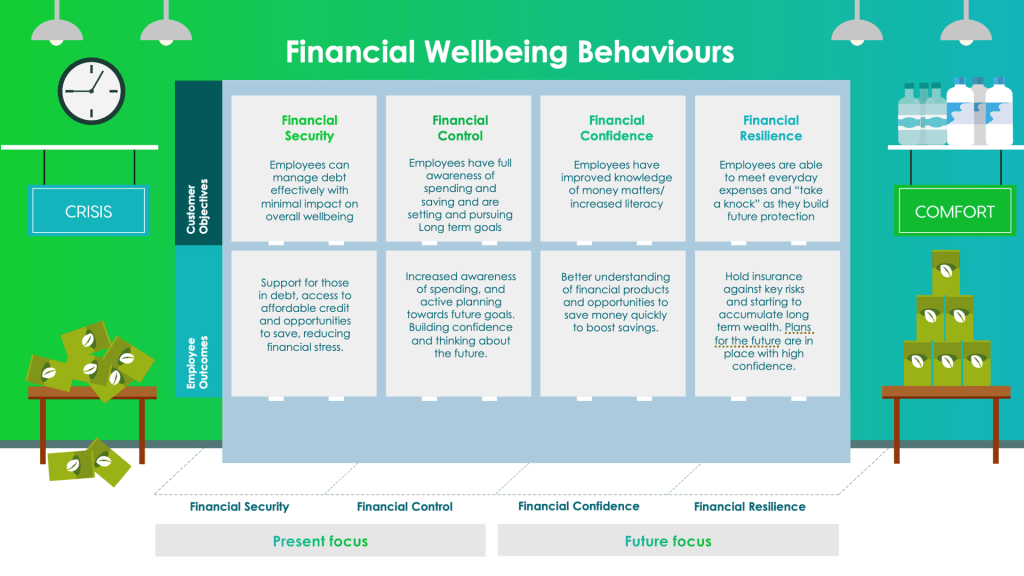

Helping employees move from crisis to comfort

Employee financial wellbeing exists along a journey from crisis to comfort – and people move up and down that journey through life, depending on various factors that impact their lives. We’ve identified four core areas of financial wellbeing and the outcomes we need to focus on for employees to develop more positive financial circumstances for themselves and their families.

Benefex have been running a series of cost-of-living focused events and webinars, exploring different aspects of financial wellbeing and how employers can support their people through the benefits toolkit – helping them on the journey to financial comfort.

In our recent webinar, we partnered with Quilter to discuss the importance of planning for later life and improving financial education with a financial planning benefit – even during an economic crisis. Our Chief Innovation Officer, Gethin Nadin, was joined by Quilter’s Head of Corporate Affiliates and Digital Advice, Kim McCracken, and Head of Advisor Coaching, Lloyd Nunn, to explore why financial planning is fundamental to employee financial wellbeing. Here are some of the key takeaways:

The importance of financial education

In a time of financial crisis or recession, financial education tends to be under the spotlight as people struggle more with their finances – and often need to take steps to mitigate costs. Whether or not it’s the right time for an individual to get financial advice depends on their unique circumstances so it’s not the case that someone can’t benefit from financial advice just because they’re on a lower salary; we don’t always know a lot about the employees that work for us – a low salary doesn’t mean that someone doesn’t have a need for financial advice. However, a high salary doesn’t always equate to an excess of money.

Financial planning myth busting – “It’s just for older, richer people”

There’s a common misconception that financial advice and planning is just for wealthy people who are much older. But financial planning and advice is for everyone – including young people and those with very little disposable income. It’s about meeting life goals and navigating different life stages, from starting to save and buying your own property, to starting a family and getting ready for retirement, or early retirement. People in their 20s who can change their behaviours now can set themselves up to have more options in the future.

Financial advice helps people understand how they can create better circumstances for themselves down the line – giving them clarity and direction when it comes to managing their finances. And it can make a real tangible difference to people; financial advice has been found to be worth nearly £5,000 a year or £47,000 in the space of a decade according to Which and Unbiased. In fact, the study found that the benefits of advice were particularly significant to people with less disposable income.

However, there’s a significant gap between the benefits that financial advice can offer and the number of people taking advice. 90% of those who have had financial advice say they found it helpful – yet only 7% of Brits had received financial advice in 2021. And with younger generations often turning to social media for financial advice (1 in 10 young people admit to using TikTok for financial advice), there’s a need to ensure that employees are seeking advice from a qualified and regulated professional.

Financial advice and the benefits package

Financial advice benefits can help employees to understand and engage with the other benefits available to them through their benefits platform. Benefits such as insurance and investment products can be intimidating and hard to understand – and when people are overwhelmed, they generally don’t take any action.

A discussion with a qualified advisor, with an opportunity to ask questions about the benefits on offer, can help ensure employees are maximising the value of their benefits. An employee who is well informed will be able to make wise decisions and influence their desired lifestyle down the road, which is specifically crucial when thinking pensions and retirement planning.

How a financial advice benefit works

Benefex now offers Quilter financial advice as a Marketplace benefit through OneHub, making it easier for employers to offer this service to their employees (either as a core benefit or at the employee’s expense). Employees get a free, no obligation meeting with a Restricted Financial Planner – which is an opportunity to ask questions of a qualified individual in a safe space.

To learn more about how the employee benefits toolkit can help employees navigate rising costs, take a look at our cost-of-living crisis special report.