Global

The UK Autumn Statement: What it means for employees

24-11-2023

The Workplace Savings Team here at Benefex have reviewed this week’s Autumn Statement and here are their comments on the main news items for employees.

Pension pot for life

Not much of a secret, having been leaked the day before, the announcement to offer employees a choice on their workplace pension provider, is nevertheless potentially big news and could represent a seismic change for UK pensions and employers. Under the proposed ‘pot for life’ or ‘lifetime pension model’, savers would have the option to ask a new employer to pay pension contributions into their existing pot.

This continues a trend we’ve seen for the UK to move to copy the Australian playbook when it comes to pension provision. While it’s likely to be attractive to members to end the proliferation of small pots, it does present a challenge to the pension industry and to employers with many questions to be addressed such as:

- How will this tie in with Auto Enrolment and the three-year re-enrolment cycle?

- Will employers be expected to manage multiple pension files, or will there be a central clearing house system, as in Australia?

- Would this be for new joiners only (from a future date) or all existing members?

- What governance structure will be in place to ensure that receiving providers are suitable and providing value for money, rather than just having the largest marketing budgets to attract and entice people to join?

Such radical change won’t come quickly and already industry experts are suggesting this may not be in place before 2030. We wait for further details that will come from a consultation.

Employee National Insurance

The rate of Employee National Insurance for employed workers will reduce from 12% to 10% on earnings between £12,570 and £50,268 a year. This change will take effect from 6th January 2024.

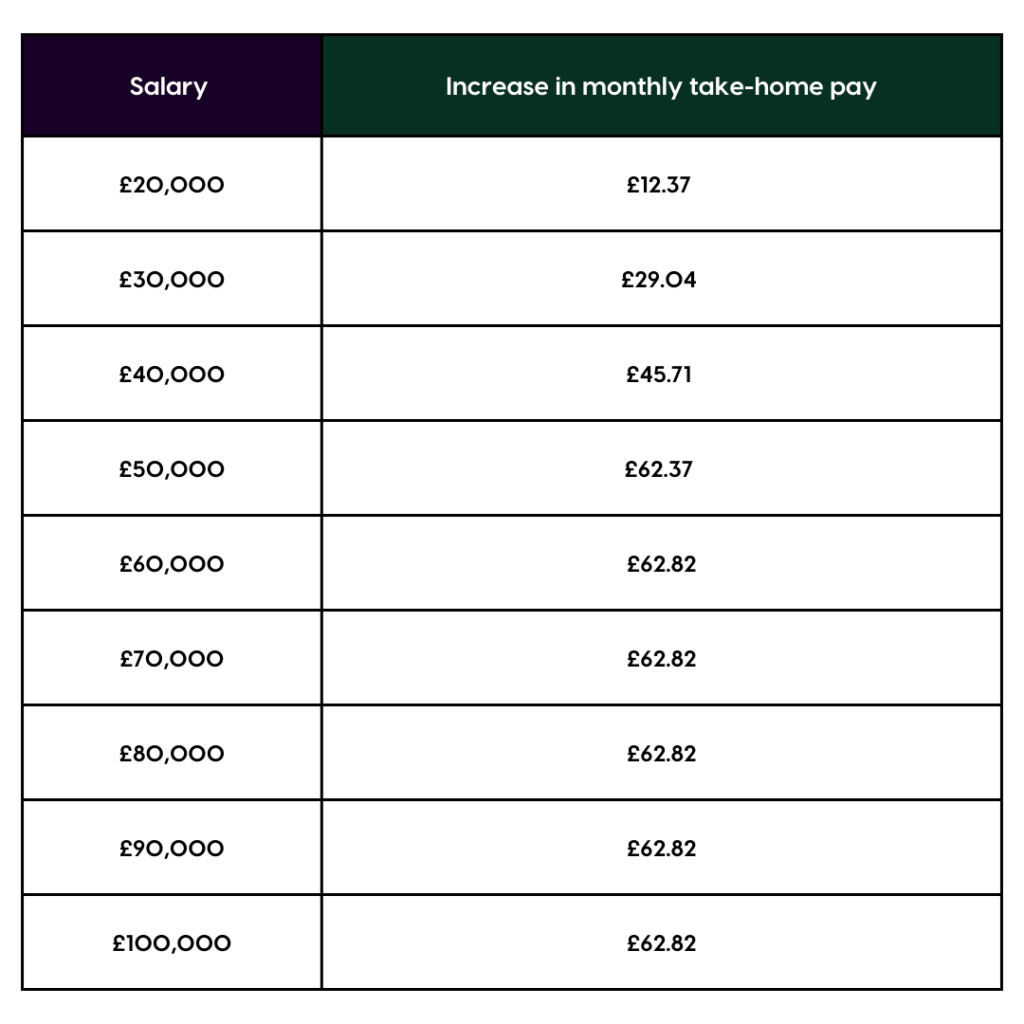

This means that an employee on £30k a year would have £29.04 more in their monthly take home pay in January than they did in December, which should soften the increase in the tax burden from the freezing on the nil-rate band and 40% tax bracket since 2021/22. See the table that details the extra take home pay for varying salary levels.

Lifetime Allowance

As announced in the Spring Budget, the lifetime allowance will be abolished from 6th April 2024 with legislation in the Autumn Finance Bill. The measures will clarify the taxation of lump sums and lump sum death benefits, and the application of protections, as well as the tax treatment for overseas pensions, transitional arrangements, and reporting requirements.

The maximum pension commencement lump sum for those without protections will be kept at 25% of the fund up to a maximum of £268,275 (25% of the lifetime allowance of £1,073,100) and frozen thereafter. On death before age 75, beneficiary drawdown plans and beneficiary annuities will continue to be excluded from income tax, maintaining the current treatment.

We welcome the detail provided which clarifies the tax treatment for employees impacted by the abolishment of the Lifetime Allowance.

Phil Klimek

Corporate Savings Advisor, Benefex

Andrew Barradell

Head of Workplace Savings, Benefex